Some day in the future, economic historians will likely consider the dramatic decline of international oil prices, which occurred in March 2020, as a turning point in the development of the global petroleum industry. This collapse puts the end to the era of expansive oil, which began after the Iraq war of 2003. That era is over now as the global economy seems to return to a period of low oil prices, similar to the one at the end of the 20th century after 1986.

There are a lot of explanations for the collapse of oil prices in the business and academic literature. Some experts think that the coronavirus pandemic undermines the global demand for petroleum, while other economists suppose that the dissolution of the coalition of OPEC countries and Russia in March 2020 was responsible for the destruction of the previous oil price equilibrium at the international oil market. However, the question of why this collapse of the oil price equilibrium happened is no longer relevant. The questions scholars should focus on now are how the decrease in oil prices will impact the economies of oil-exporting countries in the world after the pandemic? What reaction to this crisis can we expect from the governments of oil-producing countries? Finally, what will happen to the Russian economy?

The oil crisis and the escalating oil price war between Saudi Arabia and Russia of 2020 might open intellectual debate on what is the best way of the organization of the petroleum industry in the conditions of low oil prices. What model of petroleum ownership is optimal for the economy in the new age of cheap oil prices? What will the reaction of the state to this problem be? Could we expect the mass privatizations of state-owned oil companies around the world? This essay is an attempt at addressing the problem. This is the sixth blog post of the Politics & Pandemics special series, written by invited researchers Aleksei Pobedonostsev* and Nadezhda Stepanova+.

*Aleksei Pobedonostsev, Ph.D. candidate in political and social sciences (European University Institute in Florence), Aleksanteri Institute visiting fellow, Aleksei.Pobedonostsev@EUI.eu

+Nadezhda Stepanova, Ph.D. in economics, Aleksanteri Institute, Invited Researcher nadezhda.stepanova@helsinki.fi

Reading time: 14 minutes

What Will the Russian Economy Look like after oil prices collapse?

The 2020 oil crisis might become very painful for the Russian economy in the context of the detrimental consequences of the COVID-19 pandemic and the six years of economic stagnation since 2014. There is a consensus among experts that the COVID-19 pandemic will result in a global recession and a significant decrease in global oil demand (IEA, 2020). The International Monetary Fund predicts that the Russian economy will lose 5.5% of its GDP in 2020, while the Central Bank of Russia estimates a future decrease of 4-6% (CBR, 2020). Scholars and public policy experts argue that the Russian public finance is relatively well prepared for the decrease of oil prices, but it is not ready for the combination of such adverse factors as a pandemic, the global economic crisis, and the fall of oil prices at the same time. The sharp drop in oil prices will negatively impact the Russian economy as well as the state’s budget. Oil export generates 10% of Russian GDP, determines investment dynamics, and forms 37% of the federal budget income.

The last ‘black swan’ event of 2014, when the oil prices fell unexpectedly from 98 to 51,5 US dollars per barrel, led to the economic crisis of 2014-2016 in Russia. Moreover, in 2014 the crisis of oil price coincided with the imposition of international sanctions and the decrease of prices of other natural resources such as natural gas, gold, silver, and coal. During 2015-2016, oil prices have plunged several times but finally stabilized around 53 US dollars in 2017.

However, the crisis of 2014-2016 was not shaped by external factors only. Some experts point out that the economic crisis was driven also by some objective problems of the Russian economy (Aganbegyan, 2016; Aleksahenko, 2019). The economic indicators such as GDP, the level of industrial production, investments, and external trade indices decreased in 2014-2016 and returned to a weak growth only in 2017. Over all these years, the real income of Russians was decreasing or stagnated. So, in 2019 the average income of Russian households was 9,6% lower than in 2013.

Table 1. The dynamics of basic indicators in Russia

| Indicators | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

| factual data | estimation | ||||||

| GDP | 101.8 | 100.7 | 98.0 | 100.2 | 101.6 | 102.3 | 101.3 |

| Industry Index | 100.4 | 101.7 | 96.6 | 99.1 | 102.1 | 102.9 | 102.3 |

| Retail | 103.9 | 102.7 | 90.0 | 95.4 | 101.3 | 102.6 | 101.6 |

| Export | 99.2 | 95.2 | 68.7 | 104.0 | 103.8 | 104.2 | 102.3 |

| Import | 101.7 | 90.2 | 62.7 | 101.7 | 116.4 | 101.7 | 102.3 |

| Capital Investment | 100.8 | 98.5 | 91.6 | 99.1 | 104.8 | 104.3 | 103.1 |

| Consumer Price Index | 106.5 | 111.4 | 112.9 | 107.1 | 103.7 | 102.9 | 104.7 |

| Real Incomes Rate | 104.0 | 99.3 | 95.7 | 94.9 | 99.5 | 100.0 | 101.0 |

| Unemployment Rate | 4.1 | 5.4 | 5.9 | 5.6 | 5.2 | 4.8 | 4.7 |

Source: Rosstat, the Ministry of Economic Development of the Russian Federation

In Russian economic history, all previous recoveries from the economic crises and return to growth trajectories were associated with the increase of international oil prices. The ‘perfect storm’ of 2020 differs substantially from all previous crises. The COVID-19 pandemic is ruining economies around the world. The problems of the global economy lead to a lack of energy resources demand and disruption of oil logistics. So, the ‘end of the oil era’ seems to be looming.

First, the oil incomes of Russia are expected to decrease dramatically. Following the new OPEC obligations, Russia will have to decrease the level of oil production in the second half of 2020. Oil production can decrease from 564 to 450 million tons or by 23% in 2020. The Russian Ministry of Economic Development (Ministry, 2019) expected that the average price of Urals oil will be between 42,4 and 57 USD in 2020. However, the price of this sort of oil dropped to 19 USD per barrel on 14 April 2020. The Central Bank of Russia estimated the average oil price at 27 USD per barrel (Urals, 2020) in its recently issued medium-term forecast (CBR, 2020). The oil export duty in the Russian Federation dropped from 52 USD to 6.8 USD per ton starting from May 1, 2020. So, both mineral extraction tax on oil, which is calculated monthly on the basis of the actual price and currency exchange rate, and export duty, which forms the oil-related revenues of the Russian Federal Budget, are decreasing significantly. At the same time, the government expected that oil-related incomes will form 36,7% of the federal budget in 2020 (7 472,2 billion roubles of 20 379,4 billion roubles of total revenue). It is strikingly clear now that the financial plans of the Russian government, as well as the three years budgetary project, should be reviewed or postponed in the nearest future.

Table 2. The indicators of the Russian petroleum industry

| Indicators | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | ||

| Factual data | estimation | forecast (basic) | 1st quarter | |||||||

| 1 | 2 | |||||||||

| Oil price, USD per barrel (world) | 109.3 | 97.6 | 51.2 | 41.7 | 53.0 | 70.0 | 62.2 | 57.0 | 27.0 | 54 |

| Oil production, m tons | 520.6 | 525.0 | 533.2 | 545.6 | 547.0 | 555.7 | 561.0 | 564.0 | – | 140 |

| Oil export, m tons | 236.6 | 223.5 | 244.5 | 254.9 | 255.7 | 260.2 | 265.6 | 270.2 | – | 40.7 |

| Oil export, bn USD | 154.0 | 193.5 | 261.4 | 235.2 | 222.4 | – | 18 | |||

| Currency rate, rubles per 1 USD | 29.4 | 38.4 | 61.0 | 66.9 | 58.3 | 62.5 | 65.4 | 65.7 | – | |

1 – RF Ministry of Economic Development, 30.09.19

2 – The Central Bank of Russia, 24.04.20

Second, the ‘lockdown’ imposed by the Russian government generates devastating effects on the economy through the decrease of domestic demand and requires additional measures to support individual citizens and firms. In March and April 2020, the total sum of 2,1 trillion rubles is designated for the measures against COVID-19.

Third, the government will have to amend the so-called ‘national priority projects’, which were announced by Vladimir Putin in 2018. According to these priorities, the federal government plans to spend 13.2 trillion rubles on the realization of various projects until 2024. However, in the context of the economic catastrophe of 2020 the Russian government will have to reduce the budgets of these projects or totally drop them.

Does it make sense to privatize oil companies when oil prices are falling?

The most expected reaction of governments could be the radical rearrangement and reorganization of the state-owned oil companies, which are losing great money. Transformations can take various forms, the most obvious of which is the privatization of national oil companies if they face tremendous financial difficulties. Under the conditions of low oil prices, state-run oil companies lose their attractiveness for national governments as profitable assets. Therefore, some scholars think that the fall of oil prices increases the probability that the government of an oil-producing country will privatize the state-owned oil company in that country (Warshaw, 2012).

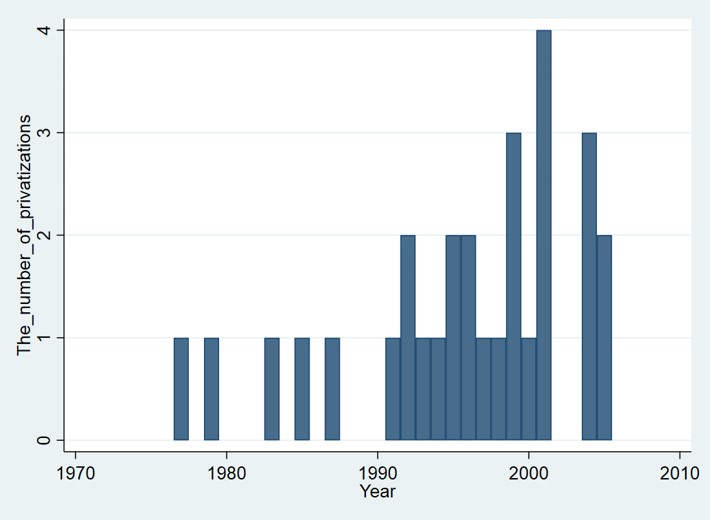

The government’s interest in petroleum privatization is determined by two factors. First, when prices are low, the nationalized oil industry does not generate good money for the government. At the same time, the government has to subsidize state-owned oil companies rather than reaping the gains of oil production. Second, the privatization of the petroleum industry could help increase the efficiency of the sector. Christopher Warshaw calculates that the greatest number of petroleum company privatizations happened at the end of the 1990s and in the early 2000s (see Figure 1). Bars show the number of petroleum company privatizations in developed and transitional economies per year. Those were the last years of decades of low oil prices before the oil boom of the 2000s started and the oil price skyrocketed. Warshaw believes that at the end of the 1990s governments of several oil-producing countries had powerful incentives to carry out the full or partial privatization of state-owned oil companies. The reason is that the petroleum industries of these countries were not very profitable after 15 years of low oil prices.

Figure 1. The numbers of petroleum privatizations by years

Source: Ch. Warshaw ‘The political economy of expropriation and privatization in the oil sector’ (2012).

The greatest number of privatization events occurred at the end of the long time period of cheap oil prices (see also Appendix). From economic history, we know that the level of oil price dropped in 1986 and remained low until the 2003 invasion of Iraq (see Figure 2).

Figure 2. The dynamics of real oil price (US dollar in 2000)

If we juxtapose the dynamics of oil prices and privatization, we will notice that during a long time period after the fall of oil prices in 1986, governments of many countries did not privatize the petroleum industry despite the low level of oil price. And this goes against our expectations. It seems that cheap oil price is a necessary but not sufficient condition for the privatization of the petroleum industry. The profitability of state-owned oil companies should fall over a long time period before the government decides to get rid of its petroleum assets.

Privatization of Rosneft in 2020: an unexplained paradox?

In March 2020, the government of Russia exchanged 10% of Rosneft shares, the biggest national oil company of Russia, for the risky assets of this company in Venezuela. The background is that during many years Rosneft, headed by Igor Sechin – a close friend of President Vladimir Putin, has been involved in the development of some projects in Venezuela. Rosneft’s participation in these projects was an important element of the Russian foreign policy in Latin America, despite the fact that the petroleum industry of Venezuela was in crisis and did not generate good profits. Eventually, Rosneft concentrated a lot of problematic assets in Venezuela, which failed to bring any revenue to the company.

Oil production in Venezuela is a rather risky business, not only because of the political and economic situation in this Latin American country is unpredictable but also because of the international economic sanctions. Hence, having petroleum assets in Venezuela makes a political risk for Rosneft because the international community could introduce new sanctions against the assets of the Russian oil company around the world at any time. Trying to get rid of toxic Venezuelan assets, Rosneft sold these assets to the Federal Government of Russia for its own shares.

However, the consequences of the 2020 deal are very significant for the Russian petroleum industry. The loss of 10% of Rosneft shares means that the Federal Government of Russia does not have the majority of shares in the company anymore. As a result of the deal, the state participation in Rosneft decreases from 50% to 40%. Therefore, from a theoretical perspective, the deal of 2020 should be classified as the privatization of the national oil company. The key beneficiary of the privatization is the top management of Rosneft, including Igor Sechin personally. Here we see the transition from state to private ownership. What is more important is that this transformation occurred immediately after the fall of oil price in March 2020.

In light of this coincidence, we wonder to what extent the privatization was driven by the decrease in oil prices. Existing academic literature predicts that the dramatic decrease in oil price stimulates the privatization of state-owned oil companies in the long-run (Guriev et al, 2011; Warshaw, 2012). At the very least, under the condition of cheap oil prices, the government does not have incentives to privatize (Jones Luong and Weinthal, 2010). On the other hand, it seems unrealistic that the fall of oil prices generated such a detrimental impact on the profitability of Rosneft in March 2020 that the Government of Russia decided to privatize this company immediately. Usually, there is a long-time gap between the collapse of oil prices (e.g. in 1986) and the implementation of decisions on the privatization of state-run oil companies. In most countries, this gap was longer than one decade.

Why then did privatization happen in March 2020, if the company was faring so well? We suggest that the privatization of 2020 was determined by the general logic of ‘bad governance’ in post-Soviet Russia (Gel’man, 2017) rather than the decrease in oil prices per se. This logic implies the nationalization of loss and the privatization of profits. Thus, Rosneft was privatized because it is quite profitable and not because of some financial difficulties. Thus far, the oil crisis and coronavirus pandemic have created uncertainty about the future of the Russian economy.

What is to come?

On April 20, a historic event happened in the international oil market. Oil prices plunged to negative values. This practically means that oil producers are expected to pay money to sell their oil. What can we say about this paradoxical situation?

On the one hand, from a long-term perspective, the age of oil is over. In the future, oil will be replaced undoubtedly by various alternative sources of energy. There is a general trend towards low-hydrocarbon energy in the global economy. On the other hand, from a short-term perspective, the period of extremely low oil prices is not to last. Oil producers cannot extract oil under the condition of negative oil prices. The global market must achieve a new oil price equilibrium soon. However, the new equilibrium oil price will not be high.

If global lockdowns and the crisis of oil prices continue, Russia will have to carry out structural economic reforms and implement very painful policy measures to adjust the economy to the new reality. In the best-case scenario, Russia will be able to use the cheap currency and natural resources advantages to develop the non-oil sectors of the economy as well as oil-refining capacities. Moreover, Russia could even participate in the restoration of collapsing global production chains, form regional product chains, and develop the infrastructure of alternative energy.

Appendix

| Privatization events (1965-2006) | |

| Argentina, 1993 | Italy, 1997 |

| Argentina, 1999 | Italy, 1998 |

| Brazil, 1985 | Italy, 2001 |

| Brazil, 1992 | Norway, 2001 |

| Brazil, 2000 | Norway, 2004 |

| Brazil, 2001 | Norway, 2005 |

| Canada, 1991 | Romania, 2004 |

| Canada, 1992 | Russian Federation, 1994 |

| Canada, 1995 | Russian Federation, 1999 |

| Canada, 2005 | Thailand, 2001 |

| China, 2000 | United Kingdom, 1977 |

| India, 1999 | United Kingdom, 1979 |

| India, 2004 | United Kingdom, 1983 |

| Italy, 1995 | United Kingdom, 1987 |

| Italy, 1996 | United Kingdom, 1996 |

Source: Warshaw, 2012, p. 58.

One Reply to “The Privatization of Rosneft: An Unintended Consequence of the Coronavirus Pandemic and the 2020 Oil Crisis”